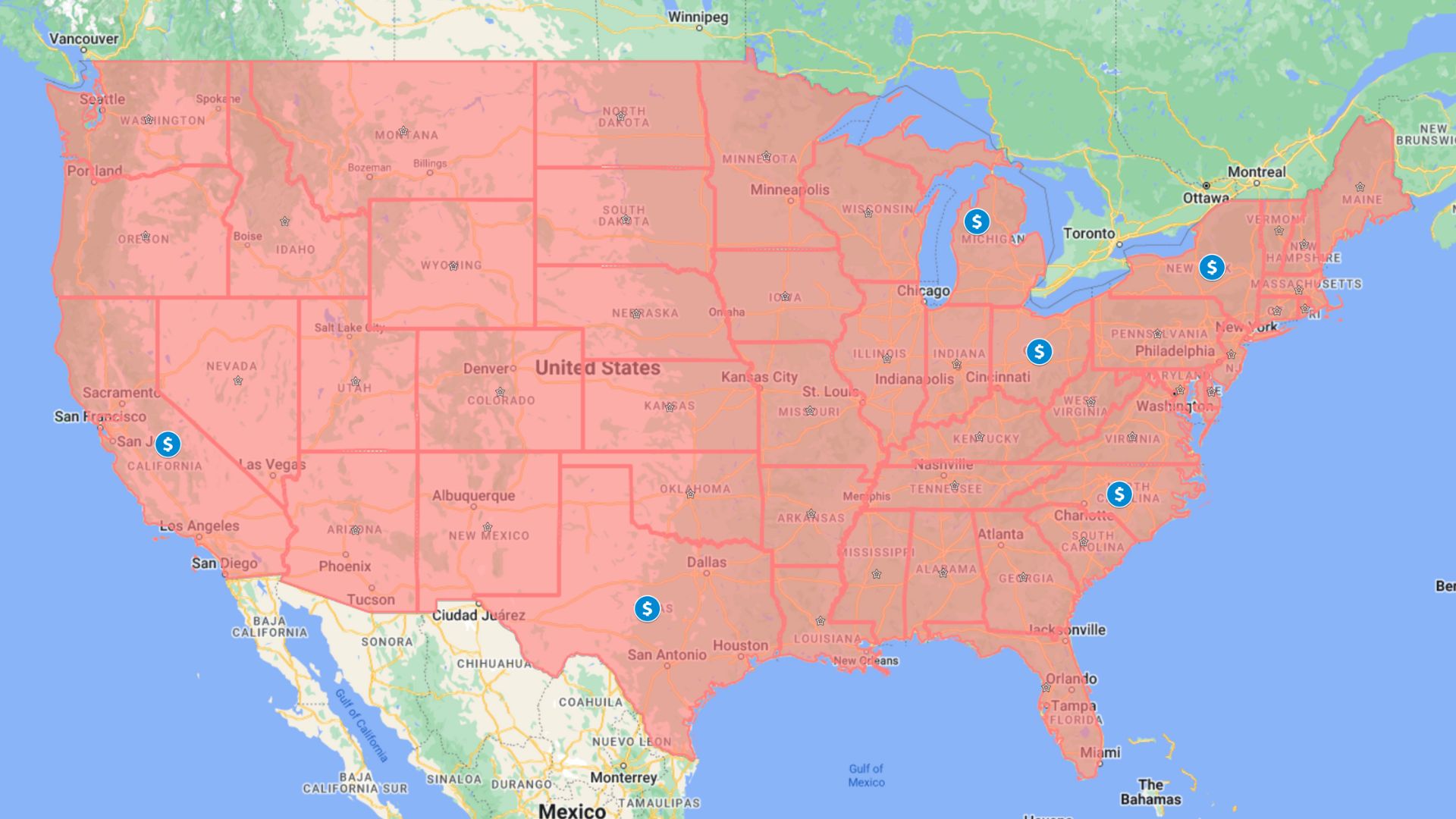

June 2024 – The U.S. remains a prime target for Chinese investment, but the competition for Chinese capital has become increasingly fierce, with states across the country vying for a slice of the pie. While California, New York, and Texas have traditionally been the top destinations, other states are emerging as strong contenders, hoping to attract a greater share of Chinese investment.

Looking Back:

- California:

- As the largest economy in the U.S., California has long been a magnet for Chinese investment. Its robust tech industry, talent pool, and favorable business climate have attracted numerous Chinese companies to establish research and development centers, data centers, and invest in tech startups.

- According to the China General Chamber of Commerce – USA (CGCC), California hosted approximately 40 operational sites and facilities for Chinese-funded enterprises in 2023, accounting for 23.2% of the total.

- The total number of employees hired by Chinese companies in California exceeds 100,000, with the tech sector accounting for over 50% of the workforce.

- Chinese investment in California in 2023 exceeded $10 billion, predominantly in tech, finance, and real estate.

- New York:

- As the U.S. financial capital, New York has attracted a significant influx of Chinese investment in the financial sector, with numerous Chinese companies establishing financial institutions and investing in the market. Its developed financial markets, mature legal framework, and abundant business resources make it highly attractive to Chinese investors.

- New York hosted around 30 operational sites and facilities for Chinese-funded enterprises in 2023, accounting for 17.4% of the total.

- The total number of employees hired by Chinese companies in New York exceeds 80,000, with the financial sector accounting for over 60% of the workforce.

- Chinese investment in New York in 2023 exceeded $8 billion, predominantly in finance, tech, and real estate.

- Texas:

- Texas is renowned for its low taxes, lenient regulations, and abundant energy resources. This has drawn Chinese investment in various sectors, including energy, manufacturing, and logistics.

- Texas hosted around 18 operational sites and facilities for Chinese-funded enterprises in 2023, accounting for 10.5% of the total.

- The total number of employees hired by Chinese companies in Texas exceeds 50,000, with the energy sector accounting for over 40% of the workforce.

- Chinese investment in Texas in 2023 exceeded $6 billion, primarily in energy, manufacturing, and logistics.

Rising Stars: As Chinese investment strategies diversify, several other states are attracting attention, including:

- Michigan: A hub for automotive manufacturing, Michigan has attracted investment from Chinese automotive parts suppliers and electric vehicle companies. In 2023, Michigan attracted over $2 billion in Chinese investment and created over 10,000 jobs.

- Ohio: Ohio’s robust manufacturing and energy sectors have drawn Chinese investment, with over $1.5 billion invested and 8,000 jobs created in 2023.

- North Carolina: North Carolina’s burgeoning tech industry has attracted investments from Chinese tech companies, with over $1 billion invested and 6,000 jobs created in 2023.

Looking Ahead:

- Intensifying Competition: With Chinese investment strategies becoming more diversified, states will face fiercer competition for Chinese investment. Attracting capital will increasingly depend on policy incentives, infrastructure development, and talent pool advantages.

- Policy Uncertainty: The U.S. political climate towards Chinese investment will continue to influence investment decisions. Scrutiny of Chinese investment, particularly in sectors considered vital to national security, is likely to become even more stringent.

- Industry Focus: Chinese companies will continue to prioritize investments in U.S. tech, finance, energy, and manufacturing industries, but they will also explore new sectors, including healthcare, agriculture, and renewable energy.

Expert Opinions:

- “States need to develop more attractive policies, such as offering tax breaks, streamlining approval processes, and enhancing infrastructure development, to stand out in the intense competition,” said Wei Hu, Chairman of the China General Chamber of Commerce – USA (CGCC).

- “Chinese companies will place a greater emphasis on risk control, selecting states with a more stable investment environment and transparent policies,” said Ying (Abby) Li, Research Director at CGCC.

Recommendations for States Seeking Chinese Investment:

1. California: Leverage its existing tech talent base, robust industrial ecosystem, and relatively friendly policy environment to attract long-term investment.

2. New York: Capitalize on its financial resources, strong legal system, and established business networks to attract investment in the financial sector.

3. Texas: Promote its low tax rates, abundant energy resources, and established manufacturing infrastructure to attract investment in energy and manufacturing.

4. Michigan: Highlight its automotive industry dominance to attract investment in auto parts and electric vehicles.

5. Ohio: Promote its strong manufacturing and energy sectors to attract investment in traditional manufacturing and energy production.

6. North Carolina: Emphasize its rapidly growing tech sector to attract investment from Chinese tech companies.

This article is based on the China General Chamber of Commerce(CGCC) ‘s Annual Business Survey of Chinese Companies in the United States.

About CGCC:

The China General Chamber of Commerce – USA (CGCC) is the largest and most influential non-profit organization representing Chinese companies in the United States. With a membership exceeding 1,000 multinational firms, it plays a crucial role in fostering understanding, promoting trade, and facilitating investment between the two economic giants. CGCC’s influence extends beyond its membership, as it serves as a leading source of information and insights on Chinese business activity in the U.S., influencing policy discussions and shaping the landscape of U.S.-China economic relations.

In conclusion, Chinese investment in the United States is poised to continue, but the competition for capital will intensify. Attracting Chinese investment will increasingly depend on states’ ability to create a stable and attractive environment for Chinese companies. By understanding the unique needs and priorities of Chinese investors, states can position themselves for success in this growing market.

This news article aims to provide context and analysis, offering a valuable resource for readers seeking to understand the evolving dynamics of Chinese investment in the U.S.